The Biden administration has proposed a number of changes that would chip away at these inequities, including a higher top tax rate on reported income, more funding and changes in rules that would help the I.R.S. to crack down on tax avoidance and eliminating the “step up” rule that allows heirs to avoid taxes on some accumulated wealth.

But none of those changes suffice to address the basic unfairness that the wealthy are living by a different set of rules, lavishly spending money that isn’t taxed as income.

Gun Grabbers not paying their fair share of taxes

Moderators: carlson1, Charles L. Cotton

-

Paladin

Topic author - Senior Member

- Posts in topic: 11

- Posts: 6313

- Joined: Thu Dec 23, 2004 4:02 pm

- Location: DFW

Re: Gun Grabbers not paying their fair share of taxes

JOIN NRA TODAY!, NRA Benefactor Life, TSRA Defender Life, Gun Owners of America Life, SAF, FPC, VCDL Member

LTC/SSC Instructor, NRA Certified Instructor, CRSO

The last hope of human liberty in this world rests on us. -Thomas Jefferson

LTC/SSC Instructor, NRA Certified Instructor, CRSO

The last hope of human liberty in this world rests on us. -Thomas Jefferson

-

srothstein

- Senior Member

- Posts in topic: 4

- Posts: 5274

- Joined: Sat Dec 16, 2006 8:27 pm

- Location: Luling, TX

Re: Gun Grabbers not paying their fair share of taxes

This statement is proof that the NY Times knows how to lie very, very well. While they made only true statements, they did it in such a way as to make you believe something that has not yet been shown to be true.The federal income tax is designed to be progressive, meaning that those who make more money are supposed to pay taxes at higher rates. But the richest Americans don’t. Public data shows that in 2018, the most recent year for which data is available, the top 0.001 percent of taxpayers — roughly 1,400 households — paid a smaller share of income in taxes than the rest of the top 1 percent. The effective tax rate for that elite group was 22.9 percent.

Statement #1 was that we have a progressive income tax and the higher your income, the higher your tax rate. This is a true statement.

Statement #2 was that a small group of the very wealthy paid taxes at an effective rate of only 22.9%. While I do not have access to the data used to calculate this, I am going to give them the benefit of the doubt and assume it is true. But a key point left out of this is what they defined as income and how they calculated the tax to get "the effective rate", which is not a rate written in the law.

Statement #3 was that this was a smaller share of their income than the remainder of the top 1%. I do not have any way to know if this is true or not.

But the implication is that these people are paying much lower shares of their income than most Americans. That has not been shown by this data and is not something I believe to be a true statement. I have a daughter who made about $30,000 last year. She had 1,700 withheld in taxes. But as a single mother, her taxable income was 0 and she received a refund of over 7,500. Subtracting the 1,700 she paid in from the refund means she had an effective tax rate of about negative 16%. So she paid much less than those rich guys who paid in 20%. My wife and I make a salary that is above the median for Texas, right about the 80th percentile (top 20%). Our effective tax rate was about 6.5%, again much lower than those rich guys.

So, using anecdotal numbers since I do not have hard data to argue with, it appears to me that we have a progressive income tax that is working as intended. The top 1% paid a significantly higher percentage of their income than did those with lower incomes. I paid a significantly higher effective tax rate than did my daughter with much lower income than me.

That is not what NY Times would have you believe though. And they are lying (as in deliberately misleading people) to try to convince us of their point of view.

And despite having done this fact check, I still like my daughter's t-shirt that said she was an English major, you do the math.

Steve Rothstein

-

Paladin

Topic author - Senior Member

- Posts in topic: 11

- Posts: 6313

- Joined: Thu Dec 23, 2004 4:02 pm

- Location: DFW

Re: Gun Grabbers not paying their fair share of taxes

This is a more realistic assessment of what is going on:

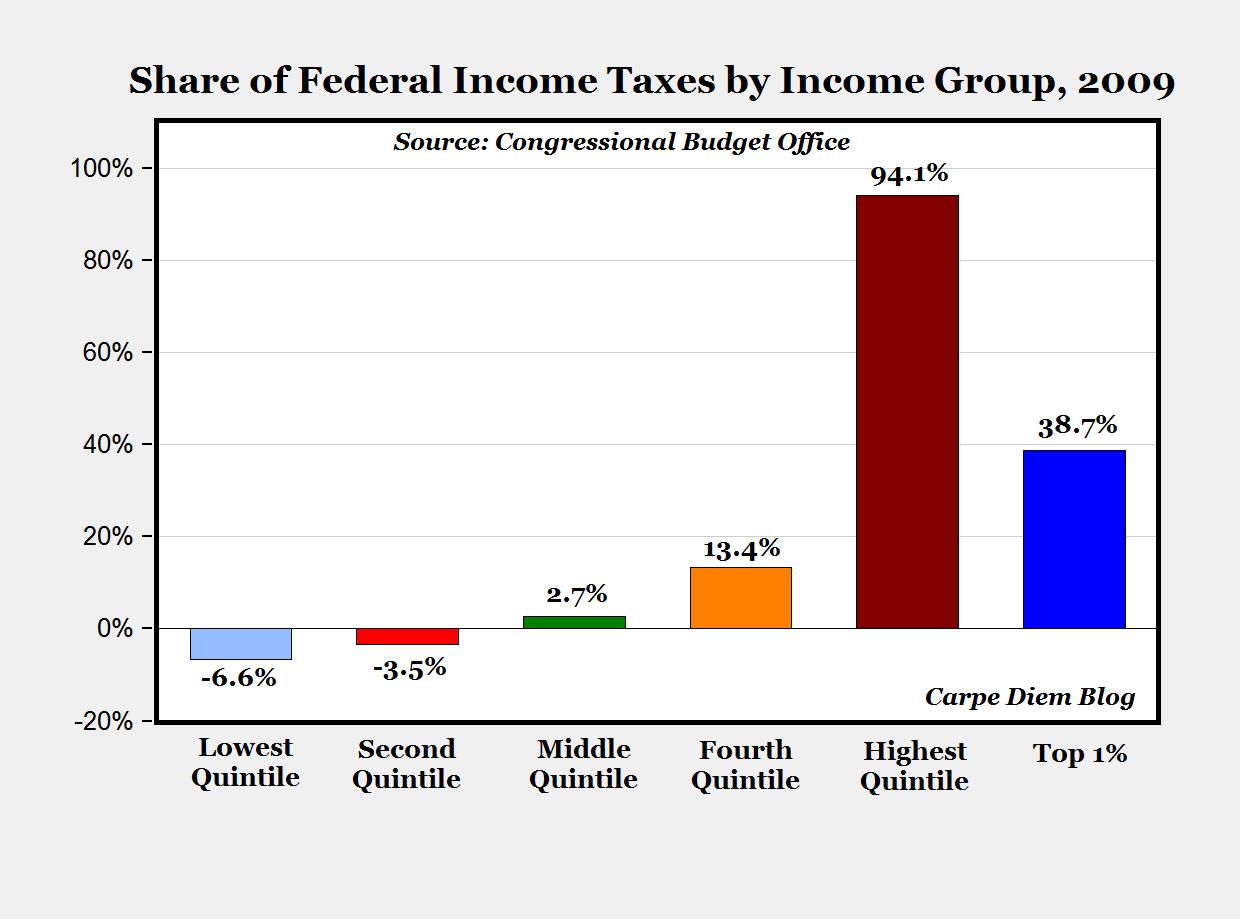

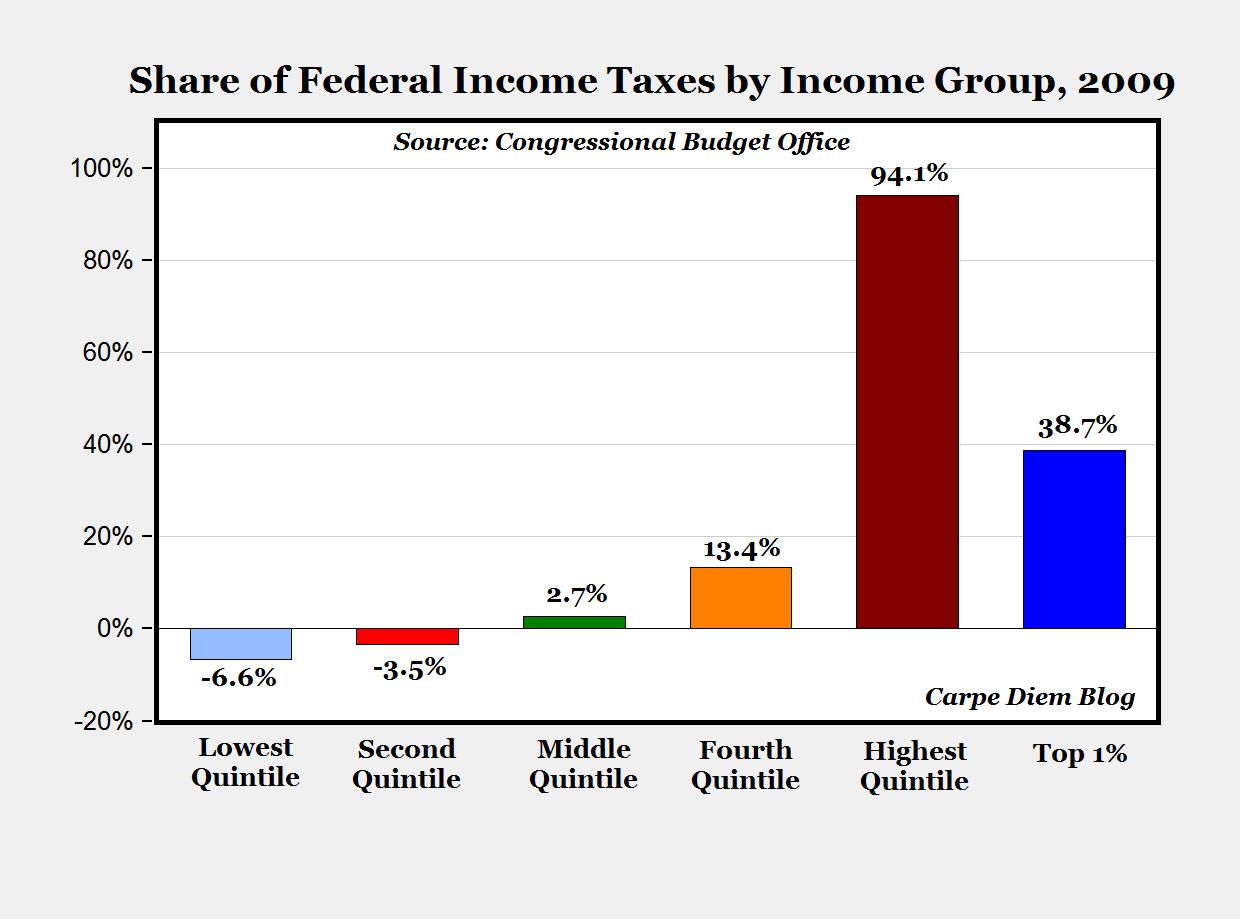

The Lower 40% or so is earning money off the "income tax". The Upper 40% is paying for almost everything... except for the richest who are paying almost nothing.

Not a fair system. But an attractive system if you are a billionaire and don't want the poor to revolt. Just pay them off with money from the middle class and millionaires and "problem solved"... unless somebody finds out. Oppps!!

The Lower 40% or so is earning money off the "income tax". The Upper 40% is paying for almost everything... except for the richest who are paying almost nothing.

Not a fair system. But an attractive system if you are a billionaire and don't want the poor to revolt. Just pay them off with money from the middle class and millionaires and "problem solved"... unless somebody finds out. Oppps!!

JOIN NRA TODAY!, NRA Benefactor Life, TSRA Defender Life, Gun Owners of America Life, SAF, FPC, VCDL Member

LTC/SSC Instructor, NRA Certified Instructor, CRSO

The last hope of human liberty in this world rests on us. -Thomas Jefferson

LTC/SSC Instructor, NRA Certified Instructor, CRSO

The last hope of human liberty in this world rests on us. -Thomas Jefferson

-

03Lightningrocks

- Senior Member

- Posts in topic: 3

- Posts: 11451

- Joined: Tue Apr 08, 2008 5:15 pm

- Location: Plano

Re: Gun Grabbers not paying their fair share of taxes

We had an employee one time who loved to constantly complain about the people who were living off his taxes. The problem was, I knew this guys income and exactly what he paid in taxes on his W4's. Every April he would talk about his income tax refund. The funny part of it was he would get back almost 5K more than what he paid in. This went on for two or three years. I would just shake my head in amazement. The point of telling this story. People in tax situations where they get back more than they paid in often don't even think about it. They will be the first ones to complain about paying taxes. This lack of "education" about taxes makes it real easy for politicians to use taxes as another method for dividing people into tribes.

NRA-Endowment Member

http://www.planoair.com

http://www.planoairconditioningandheating.com

http://www.planoair.com

http://www.planoairconditioningandheating.com

-

srothstein

- Senior Member

- Posts in topic: 4

- Posts: 5274

- Joined: Sat Dec 16, 2006 8:27 pm

- Location: Luling, TX

Re: Gun Grabbers not paying their fair share of taxes

I think you are misinterpreting that chart. It says that the people with incomes in the lowest 40% average collecting money from the income tax system instead of paying in. The people who are in the middle income group (earn 40 to 60% of the income per year) pay about 2.7% of the total income tax collected by the US. I would guess that this means that the reflex point where they start paying instead of collecting is somewhere in this group. The people in the 4th quintile (earning from 60 to 80% of the income) pay in a total of about 13.4% of the income tax collected by the US. These lines are pretty clear and not too confusing. The next line says the top quintile pays 94.1% of the total tax collected. This now accounts for 110.2% of the tax collected, but it totals about 100% if you then subtract the two lowest groups who collected instead of paying in. But that means that the last line, which shows the top 1% was already included in the 94.1% of the top quintiles, which makes sense as they are part of that quintile. That means that the top 1% of income earners paid 38.7% of the income tax collected. Another way to write that is that the group from 80% to 99% paid 55.4% of the tax collected and the top 1% paid 38.7%, totaling 100% between all groups.Paladin wrote: ↑Tue Jun 15, 2021 7:40 am This is a more realistic assessment of what is going on:

The Lower 40% or so is earning money off the "income tax". The Upper 40% is paying for almost everything... except for the richest who are paying almost nothing.

Not a fair system. But an attractive system if you are a billionaire and don't want the poor to revolt. Just pay them off with money from the middle class and millionaires and "problem solved"... unless somebody finds out. Oppps!!

The chart should have made this clear, but it is the only way to read it and not come up with more than 100% of the total income tax collected being allocated into the various groups. Again, it shows that the higher the income, the greater the percentage of income tax collected by the US (which could be slightly different from the percentage of their income paid in taxes).

Steve Rothstein

-

Paladin

Topic author - Senior Member

- Posts in topic: 11

- Posts: 6313

- Joined: Thu Dec 23, 2004 4:02 pm

- Location: DFW

Re: Gun Grabbers not paying their fair share of taxes

I think we are largely saying the same thing... with the exception of the wealthiest. When George Soros paid ZERO tax (that is ZERO POINT ZERO ZERO) for 3 years.... he was not representative of the 5th quintile (my group) which is paying an exorbitant share of taxes.srothstein wrote: ↑Tue Jun 15, 2021 8:48 pmI think you are misinterpreting that chart. It says that the people with incomes in the lowest 40% average collecting money from the income tax system instead of paying in. The people who are in the middle income group (earn 40 to 60% of the income per year) pay about 2.7% of the total income tax collected by the US. I would guess that this means that the reflex point where they start paying instead of collecting is somewhere in this group. The people in the 4th quintile (earning from 60 to 80% of the income) pay in a total of about 13.4% of the income tax collected by the US. These lines are pretty clear and not too confusing. The next line says the top quintile pays 94.1% of the total tax collected. This now accounts for 110.2% of the tax collected, but it totals about 100% if you then subtract the two lowest groups who collected instead of paying in. But that means that the last line, which shows the top 1% was already included in the 94.1% of the top quintiles, which makes sense as they are part of that quintile. That means that the top 1% of income earners paid 38.7% of the income tax collected. Another way to write that is that the group from 80% to 99% paid 55.4% of the tax collected and the top 1% paid 38.7%, totaling 100% between all groups.Paladin wrote: ↑Tue Jun 15, 2021 7:40 am This is a more realistic assessment of what is going on:

The Lower 40% or so is earning money off the "income tax". The Upper 40% is paying for almost everything... except for the richest who are paying almost nothing.

Not a fair system. But an attractive system if you are a billionaire and don't want the poor to revolt. Just pay them off with money from the middle class and millionaires and "problem solved"... unless somebody finds out. Oppps!!

The chart should have made this clear, but it is the only way to read it and not come up with more than 100% of the total income tax collected being allocated into the various groups. Again, it shows that the higher the income, the greater the percentage of income tax collected by the US (which could be slightly different from the percentage of their income paid in taxes).

The hidden object of the "progressive" personal income tax is to serve as an obstacle for the 5th quintile from becoming as wealthy as the 0.001%. It's much harder to save when your earnings from labor are heavily taxed (Currently 37%... at one time the top rate was 94%)

JOIN NRA TODAY!, NRA Benefactor Life, TSRA Defender Life, Gun Owners of America Life, SAF, FPC, VCDL Member

LTC/SSC Instructor, NRA Certified Instructor, CRSO

The last hope of human liberty in this world rests on us. -Thomas Jefferson

LTC/SSC Instructor, NRA Certified Instructor, CRSO

The last hope of human liberty in this world rests on us. -Thomas Jefferson

-

srothstein

- Senior Member

- Posts in topic: 4

- Posts: 5274

- Joined: Sat Dec 16, 2006 8:27 pm

- Location: Luling, TX

Re: Gun Grabbers not paying their fair share of taxes

I agree that for all except the top 1%, we are saying the same thing. I even agree that we have a problem when people collect money from a tax instead of paying any in (the lowest 40%). I can understand (not agree with but understand) if they paid 0. But there are several tax credits (child and earned income to name two) that have turned our tax system into a wealth redistribution system, and that is simply wrong. It corrupts anyone's faith and understanding of taxes.Paladin wrote: ↑Wed Jun 16, 2021 7:23 amI think we are largely saying the same thing... with the exception of the wealthiest. When George Soros paid ZERO tax (that is ZERO POINT ZERO ZERO) for 3 years.... he was not representative of the 5th quintile (my group) which is paying an exorbitant share of taxes.

The hidden object of the "progressive" personal income tax is to serve as an obstacle for the 5th quintile from becoming as wealthy as the 0.001%. It's much harder to save when your earnings from labor are heavily taxed (Currently 37%... at one time the top rate was 94%)

I am not sure I agree with your last statement. For one thing, when the top 1% of the income earners pay 38.7% of the taxes collected in the country I cannot say they are paying next to nothing. And I am not sure the goal of the tax system is to stop anyone from moving up in income at any level, though I will stipulate that it does have a tendency towards that effect. This has led to the common belief that there are times where a small pay raise actually increases your taxes enough to reduce your take-home income by moving you to a higher tax bracket. I know it does not really do that because of the way the taxes are calculated, but it is a common belief.

But everything we have both said is why I strongly support a flat tax rate. If you have income, and I don't care what the source is as a general rule, you pay X percent in income tax. I love the idea of making it a straight 10% and then saying the government has to live on whatever income that generates, but I am not sure that is really feasible. I have suggested taking the federal budget and subtracting any income from other sources (other taxes, customs duties, etc.) and dividing the remainder by the average per capita income in the US. The resulting percentage is the flat rate tax level. And it can never be raised higher than the first year we do this.

So we both agree, I think, that our income tax system needs to be fixed. We may not agree on the exact fixes, but we agree it needs fixing.

Steve Rothstein

-

crazy2medic

- Senior Member

- Posts in topic: 1

- Posts: 2453

- Joined: Sun Nov 08, 2015 9:59 am

Re: Gun Grabbers not paying their fair share of taxes

Flat 18% across the board, congress can raise it to 24% in times of war but it automatically reverts back to 18 every 2yrs, Federal Government must live within it's means!

Government, like fire is a dangerous servant and a fearful master

If you ain't paranoid you ain't paying attention

Don't fire unless fired upon, but if they mean to have a war let it begin here- John Parker

If you ain't paranoid you ain't paying attention

Don't fire unless fired upon, but if they mean to have a war let it begin here- John Parker

-

Paladin

Topic author - Senior Member

- Posts in topic: 11

- Posts: 6313

- Joined: Thu Dec 23, 2004 4:02 pm

- Location: DFW

Re: Gun Grabbers not paying their fair share of taxes

Agree regarding the flat tax. If everyone has an equal stake in America and everyone paid an equitable share of the expenses we would have a better system.srothstein wrote: ↑Wed Jun 16, 2021 7:55 pmI agree that for all except the top 1%, we are saying the same thing. I even agree that we have a problem when people collect money from a tax instead of paying any in (the lowest 40%). I can understand (not agree with but understand) if they paid 0. But there are several tax credits (child and earned income to name two) that have turned our tax system into a wealth redistribution system, and that is simply wrong. It corrupts anyone's faith and understanding of taxes.Paladin wrote: ↑Wed Jun 16, 2021 7:23 amI think we are largely saying the same thing... with the exception of the wealthiest. When George Soros paid ZERO tax (that is ZERO POINT ZERO ZERO) for 3 years.... he was not representative of the 5th quintile (my group) which is paying an exorbitant share of taxes.

The hidden object of the "progressive" personal income tax is to serve as an obstacle for the 5th quintile from becoming as wealthy as the 0.001%. It's much harder to save when your earnings from labor are heavily taxed (Currently 37%... at one time the top rate was 94%)

I am not sure I agree with your last statement. For one thing, when the top 1% of the income earners pay 38.7% of the taxes collected in the country I cannot say they are paying next to nothing. And I am not sure the goal of the tax system is to stop anyone from moving up in income at any level, though I will stipulate that it does have a tendency towards that effect. This has led to the common belief that there are times where a small pay raise actually increases your taxes enough to reduce your take-home income by moving you to a higher tax bracket. I know it does not really do that because of the way the taxes are calculated, but it is a common belief.

But everything we have both said is why I strongly support a flat tax rate. If you have income, and I don't care what the source is as a general rule, you pay X percent in income tax. I love the idea of making it a straight 10% and then saying the government has to live on whatever income that generates, but I am not sure that is really feasible. I have suggested taking the federal budget and subtracting any income from other sources (other taxes, customs duties, etc.) and dividing the remainder by the average per capita income in the US. The resulting percentage is the flat rate tax level. And it can never be raised higher than the first year we do this.

So we both agree, I think, that our income tax system needs to be fixed. We may not agree on the exact fixes, but we agree it needs fixing.

Historically a great power like America spends about 20% of its economy on the government. That means a fair flat tax is in that neighborhood. In my mind everyone today who pays under 20% is living off the people who pay over 20%. You want lower taxes than that? No problem, cut government expenses.

I don't know if you understand that what ProPublica is saying is that the wealthiest Billionaires are often times paying ZERO income tax during a year. They are NOT heavily taxed like people who work for a living. On average, instead of paying a fair 20%, they are paying 3.4%. My family happens to pay exorbitant taxes (way above 20%) so that madman George Soros can corrupt our government and the lower half can live on entitlements. I don't mind helping children and those who can not provide for themselves... but those who can provide for themselves (i.e. Billionaires) shouldn't be freeloading off the most productive members of society (i.e. people who work hard for a living).

I don't believe that "unearned income" from things like investments should be taxed lower or slower than "earned income" from productive labor. It is a moral abomination. Milton Friedman said that the worst tax is a tax on productive activity. He was absolutely right.

JOIN NRA TODAY!, NRA Benefactor Life, TSRA Defender Life, Gun Owners of America Life, SAF, FPC, VCDL Member

LTC/SSC Instructor, NRA Certified Instructor, CRSO

The last hope of human liberty in this world rests on us. -Thomas Jefferson

LTC/SSC Instructor, NRA Certified Instructor, CRSO

The last hope of human liberty in this world rests on us. -Thomas Jefferson